Is Your Small Business Making Enough Profit?

Running your own company is hard. To make it worthwhile, the business needs to be profitable. But what does that mean? How much profit should a small business make?

Read on!

Check out our article about small business management here.

What is profit?

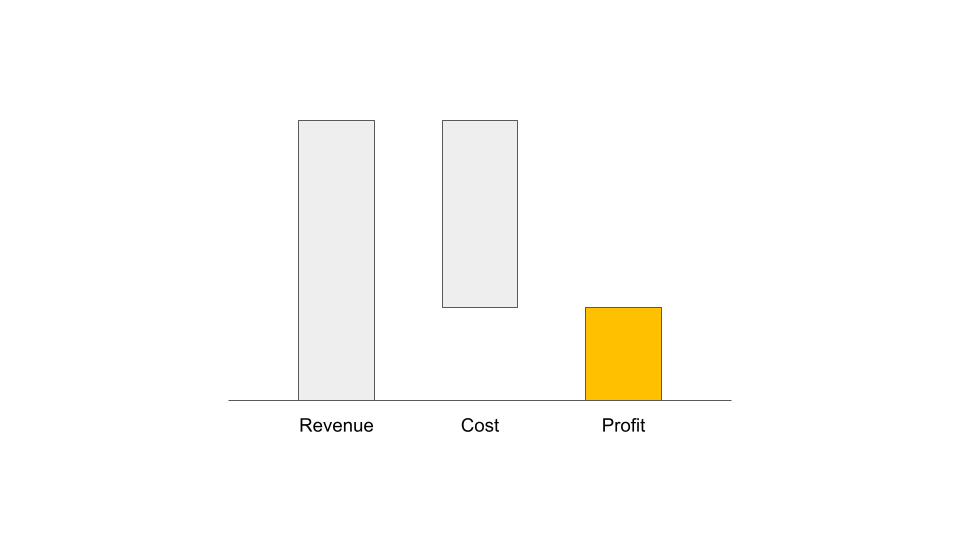

Profit is the difference between the money your business earns, your revenue, and the money your business spends, your expenses.

If revenue is greater than your cost and expenses, you are making a profit.

If revenue is smaller than your cost and expenses, you are making a loss.

The profit that is available for you to take out of the company is also called net income.

Check out how to calculate profit and profit margins here.

MAJOR REVENUE SOURCES

The major revenue sources for businesses are

- Revenue from selling goods

- Revenue from selling services

- Revenue from licensing (brands or software)

- Revenue from financial transactions, e.g. interest.

MAJOR COST AND EXPENSE TYPES

The major types of cost are

- Cost of goods sold (COGS, including some of the below)

- Staff cost (salaries)

- Cost of financing (interest rates)

- Offices and buildings

- Energy

- Marketing cost

Depending on your industry, different types might be dominant.

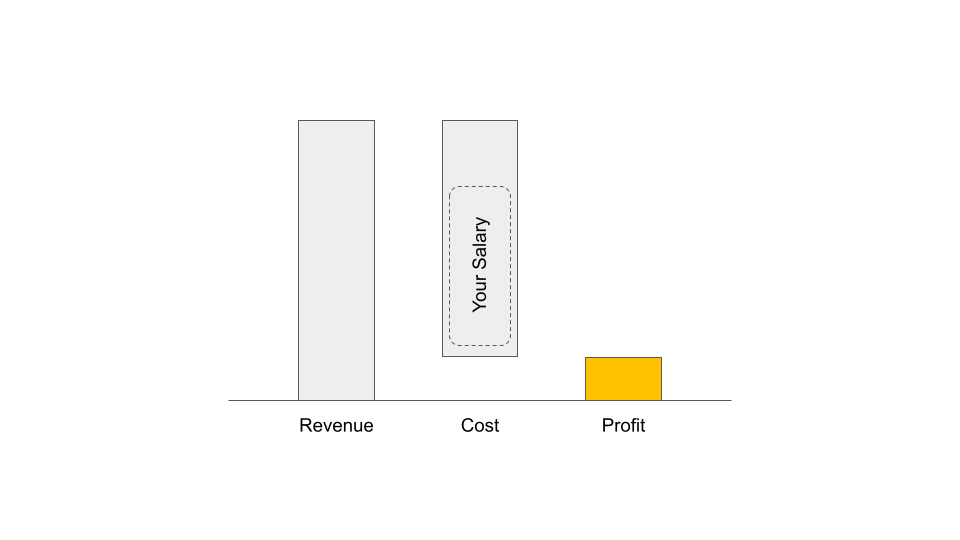

Is your salary part of the profit

If you are serious about building a business that can survive on its own, your revenue definition needs to reflect that.

The central question to answer is this:

When calculating profit, do you including or exclude your salary as the business owner.

To explain, let’s use an example:

- 200,000 USD in revenue

- a salary for you of 100,000 USD and

- 80,000 USD in other cost.

PROFIT INCLUDING SALARY

If you intend to run a sole proprietorship (with maybe some support left and right), your salary should not be part of your expenses.

Your salary is part of or equivalent with the profit of the company.

Profit = sales – all cost (except your salary)

120,000 = 200,000 – 80,000

This profit expression assumes that the money the business leaves over at the end of the month is what you live off.

PROFIT ON TOP OF YOUR SALARY

You intend to build a sustainable business that can run without you? For example to sell it or to hire an external CEO? Then you have to look at profit differently.

In this case, your salary needs to be viewed as an expense like all other salaries.

Profit = sales – all cost (incl. your salary)

20,000 = 200,000 – 180,000

You see how different the profitability is depending on how you look at it.

For the rest of this article, we’ll use the second definition, where your salary is an expense.

What influences profit

Before we look at what profit your small business should have, let’s have a look at which factors influences profit.

INDUSTRY & BUSINESS MODEL

The first major factor that will influence your profit is the industry and business model. Some industries have low profit margins (the percentage of revenue that you keep as profit), while others have higher margins.

SIZE

Of course, the size of your business will have a determining impact on your profit. If you have 100,000 vs 10 million USD in revenue will lead to different profits.

In addition, size impacts profitability. Rising overhead cost on the one side and an increased likelihood of breaking even influence your margins.

GROWTH

For most young and ambitious companies, growth is what reduces profit. If you’re stable, you keep your margin to yourself. If you grow, you will in most cases spend a good portion of that margin on the growth.

Examples for cost associated with growth:

- Hiring more people

- Buying inventory

- Marketing cost

MARKET POSITION AND USP

Besides the above, there’s your strategic positioning, your competitive strength and the value you generate for your clients.

WANT TO INCREASE YOUR PROFITABILITY? BOOK A CALL.

The better your product or service is, the more you can charge and the better your margins. The better you are at finding good deals, the better the internal rate of return of your investment firm.

OPERATIONAL EFFECTIVENESS

Next to charging more for your product or service, you can also increase profit by spending less. If you manage to incur less cost and product stable or increasingly good results, your profits will increase as well.

Personal Alternatives

Let’s get back to our question. How much profit should a small business make?

There is no one right answer, but there are better and worse answers. Let’s approach a good answer to this the following way.

SALARY AS A FAIR-MARKET VALUE

Assume your salary covers the value you generate in your day-to-day. It’s what you would earn if you were doing the same job for another company, not your own.

This means: As soon as your cashflow allows it, pay yourself a fair market value.

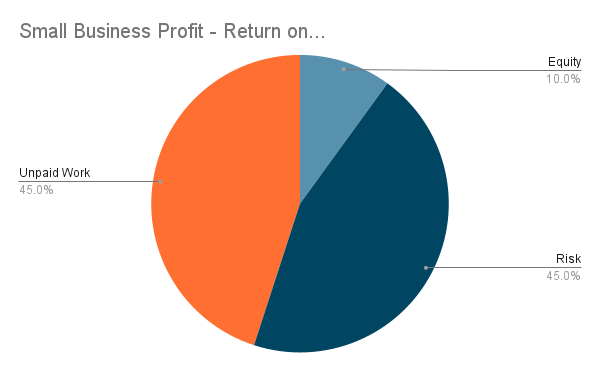

PROFIT THROUGH RISK AND CAPITAL

So if it’s not the value of your labor, what is it that the profit of your company represents?

It’s the combination of capital invested and the risk associated with it.

If you put money in the company, then this money is at risk to be lost.

The same is true for your job as the CEO. Depending on how well you run your company, you can’t be certain whether or not you still have this job tomorrow.

So basically, the risk you take as entrepreneur multiplied with the capital you put in is why your company needs to generate profit.

OTHER EARLY INVESTMENTS

In addition, also your salary will be in many cases not a fair market value compared to the hours you put in. In the early years of being an entrepreneur, you will usually work more and earn less than someone in a regular job.

This is another “investment” that you company needs to turn into profit.

WHAT DOES THIS MEAN FOR PROFITABILITY

Coming back to the question of how much profit is enough, you have to decide how much you need to be compensated for

- The capital you have put into it (your equity)

- The risk you take running the company

- The unpaid or underpaid work you’ve put in

RETURN ON EQUITY

To understand which percentage in profit margin that means, we’ll have to use some additional considerations.

For the capital you invested, we have to look at the return on equity. It tells you how much profit is generated for each dollar of your own money in the company.

Let’s assume you have invested 50,000 USD as equity in the company and generate a profit of 10,000 per year. Then your return on equity is 10,000 divided by 50,000 = 20%.

The capital part is easy to calculate: The S&P500 generate roughly a 10% return. So if you’re company “just” produces 10% return on equity, you might as well stop running the business and invest in the stock market.

You can also increase you return on equity by using debt financing. This so-called leverage effect boosts return on equity as long as your company’s profitability is greater than the interest rate of the debt.

If you do the math on return on equity in your company, you will most likely realize that this is not a relevant number. If you have been successfully operating for a few years, your company has likely grown. It will probably easily generate a decent return on the equity you’ve put in years ago.

ACCOUNTING FOR RISK AND UNPAID WORK

Now that we know how much money your invested capital needs to earn (at least 10% per year), here comes the more personal question:

How much additional profit do you have to make the risk and the extra work worthwhile.

Let’s say you have 50,000 USD invested in your business. You pay yourself a salary that is okay.

The return on equity of 5,000 USD per year is probably not enough to make you work long hours and worry about employees, vendors, tax, legal, customers etc.

How much does your business have to generate on top of that to make the risk and extra work worth it. Another 5,000? Another 50,000? Another 100,000?

If the answer to that question is realistic depends on your company size and the other factors above.

PROFIT GOALS AS AN ABSOLUTE NUMBER VS. PERCENTAGE

If you run your own business, you will in many cases look for a certain amount of profit rather than a percentage.

And that is a feasible way of looking at it.

Set an absolute profit goal, and then design revenue and profitability around it.

In contrast, setting profit goals as profitability is the right choice if you plan to sell your company. The potential buyer will be looking for a stable profitability that is at least on par with industry standards. Or lower, but justifiably so due to high growth.

GOALS

Another variable to factor in are your goals. What do you want to achieve with your company? Do you want to sell it at a point? Do you want to exit at a point and just hold it as an asset?

Depending on what your goals are, the profit you can realistically expect will vary.

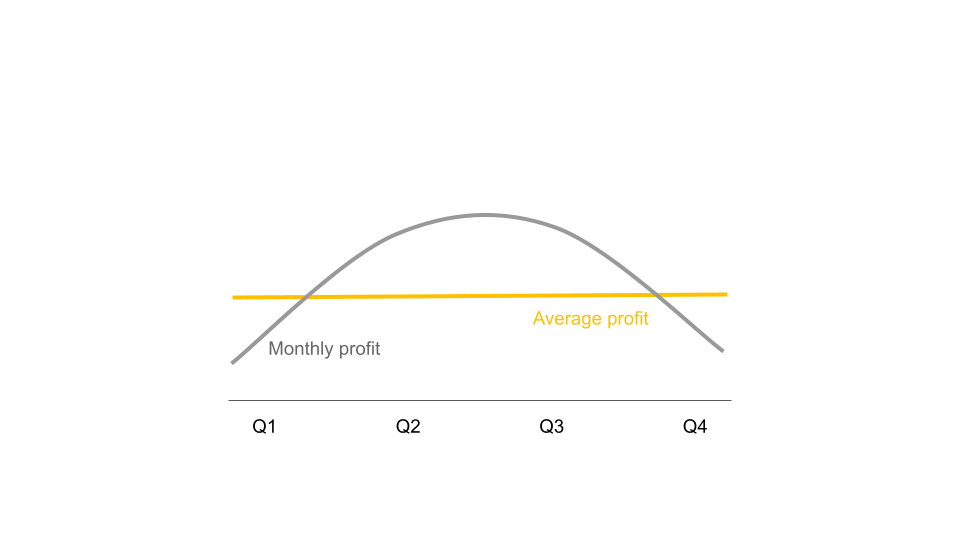

VOLATILITY

Lastly, when thinking about profit, you’ll have to factor in volatility.

Does your business experience unexpected drops in revenue and profit? Or is your business subject to a strong seasonality?

In both cases, your profit in good months needs to be even higher. It needs to be able to balance slower months for you to still arrive at a good average profit.

Think about your local ice cream parlor – they’ll have to make large profits during summer to balance the slower or non-existent winter season.

Average Profits

Now that we explored different views on your profit, let’s look at what a normal profit is.

We’ll express these as profitability numbers, as absolute profit largely depend on revenue.

PROFIT BY COMPANY INDUSTRY

NYU Stern release regular profitability numbers for various industries. Here are some highlights (net margin after tax):

- Advertising: 10.0 %

- Business and consumer services: 8.2 %

- Computer Services: 6.0 %

- Food Wholesalers: 1.8 %

- Healthcare Information Technology: 17.4 %

- Retail (online): 5.7 %

- Software (averaged, please see link for details): 17.1 %

- Total Market: 10.9 %

So what are your profit goals? And how do you compare to your industry? Let us know in the comments.

DECEMBER 5, 2022